Interest on deposit7. (1) Interest at the rate, to be notified by the Government, compounded yearly shall be credited to the account till the account completes fourteen years.(2) In case of account holder opting for monthly interest, the same shall be calculated on the balance in the account on completed thousands, in the balance which shall be paid to the account holder and the remaining amount in fraction of thousand will continue to earn interest at the prevailing rate.

In the first line, it says interest will be credited till the completion of 14 years from the date of opening of account. Whereas this account matures in 21 years from the date of opening of account.

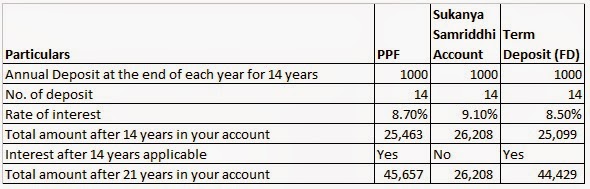

So, as per above, you will not get any interest for 7 years from 15th year to 21st year. During this period you will not earn any interest. How does this impact your investment decision and by how much? Let us with the help of example. I have not considered lock-in period requirement for the PPF while comparing. Compounding has been assumed to be annual.

|

| PPF vs Sukanya Samriddhi vs FD |

In the above table, it is clear that PPF and FD are giving much better returns than Sukanya Samriddhi Account. But wait, we need to look from the point of view of tax as well.

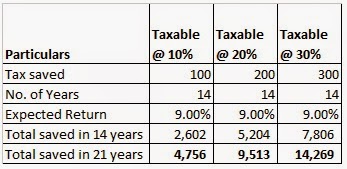

|

| Tax Savings |

This tax saving is applicable to both PPF and SSA. For FD, tax saving is applicable if it is for more than 5 years.

Even after adding tax saving to all the three, it is clear that PPF and FD, both are definitely better than SSA in all cases.

Please note that interest on FD is taxable. But still it turns out to be better option.

: Sukanya Samriddhi Account – Interest Rate Notified

: Sukanya Samriddhi Account (SSA) vs Public Provident Fund (PPF)

: Withdrawal from PPF