Objectives

- To mobilize the gold held by households and institutions in the country.

- To provide a fillip to the gems and jewellery sector in the country by making gold available as raw material on loan from the banks.

- To be able to reduce reliance on import of gold over time to meet the domestic demand.

Features

- Gold Monetization Scheme is proposed to be tax-free i.e. no capital gains tax, wealth tax or income tax will be levied on the interest as well as on the appreciation in the value of deposited gold.

- The bank will commit to paying an interest to the customer which will be payable after 30/60 days of opening of the Gold Savings Account. The amount of interest rate to be given is proposed to be left to the banks to decide. Both principal and interest to be paid to the depositors of gold, will be ‘valued’ in gold. For example if a customer deposits 100 gms of gold and gets 1 per cent interest, then, on maturity he has a credit of 101 gms.

- The Minimum Quantity of gold that individuals or institutions can deposit is proposed to be set at 30 gms, so that even small depositors are encouraged. Gold can be in any form (bullion or jewellery). The interest on the deposited gold will also be given in the form of value of gold. For instance the account balance of the individual who deposited 100 gms of gold at an interest rate of 1% p.a. would be 101 gms after 1 year.

- Holder of the Gold is required to get the gold tested for the purity using XRF machine test at any of the 350 Hallmarking Centres that are Bureau of Indian Standards (BIS) certified at a nominal fee. These testing centres will provide estimated pure value of gold. If the holder agrees to the value, he will be required to fill-up a Bank/KYC form and give his consent for melting. If the customer does not agree to the XRF machine test, he can take his jewellery back at this stage. This process would take approx. 45 minutes.

- After receiving the customer’s consent for melting the gold for conducting a further test of purity, at the same collection centre, the gold ornament will then be cleaned of its dirt, studs, meena etc. The studs will be handed-over to the customer there itself. Net weight of the jewellery will be taken after such removals and told to the customer.Then, right in front of the customer the jewellery will be melted and through a fire assay, its purity will be ascertained. These centres have viewing galleries from where the customer can see the entire process. The time taken is expected not to exceed 3-4 hours.

- When the results of the fire assay are told to the customer, he has a choice of either refusing to accept, in which case he can take back the melted gold in the form of gold bars, after paying a nominal fees to that centre; or he may agree to deposit his gold (in which case the fee will be paid by the bank). If the customer agrees to deposit the gold, then he will be given a certificate by the collection centre certifying the amount and purity of the deposited gold.

- When the customer produces the certificate of gold deposited at the Purity Testing Centre, the bank will in turn open a ‘Gold Savings Account’ for the customer and credit the ‘quantity’ of gold into the customer’s account. Simultaneously, the Purity Verification Centre will also inform the bank about the deposit made.

- The customer will have the option of redemption either in cash or in gold, which will have to be exercised in the beginningitself (that is, at the time of making the deposit). This means if opted for gold, the physical gold in form of bullion will be given at the time of maturity and if opted for cash, the amount equivalent to the prevailing market value of gold at the time of maturity will be given to the depositor.

- The tenure of the deposit will be minimum 1 year and with a roll out in multiples of one year. Like a fixed deposit, breaking of lockin period will be allowed.

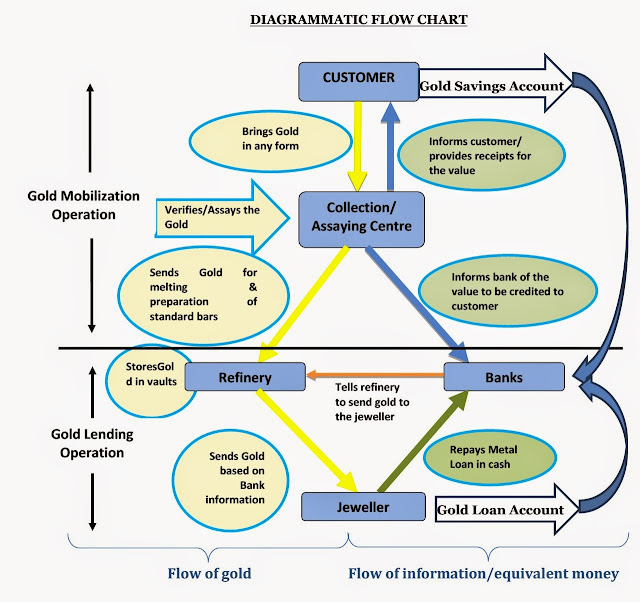

Chart View

|

| Gold Monetization Scheme – Diagram |

Melting Charges

| Gold quantity | Charges |

|---|---|

| Minimum charges/upto 100 gms | INR 500 per lot |

| 100 gms to 200 gms | INR 600 |

| 200 gms to 300 gms | INR 700 |

| 300 gms to 400 gms | INR 800 |

| 400 gms to 500 gms | INR 900 |

| 500 gms to 600 gms | INR 1000 |

| 600 gms to 700 gms | INR 1100 |

| 700 gms to 800 gms | INR 1200 |

| 800 gms to 900 gms | INR 1300 |

| 900 gms to 1000 gms | INR 1400 |

Other Charges

| Charge Type | Amount |

|---|---|

| Testing/fire assaying charges | INR 300 |

| Stone removal charges | at actuals (minimum INR 100) |

| Melting loss | at actuals |

Utilization of Deposited Gold

- CRR/SLR : To incentivize banks, it is proposed that they may be permitted to deposit the mobilized gold as part of their CRR/SLR requirements with RBI. This aspect is still under examination.

- Foreign Currency : Banks may sell the gold to generate foreign currency. The foreign currency thus generated can then be used for onward lending to exporters / importers.

- Coins : Bank may convert mobilized gold into coins for onward sale to their customers

- Exchanges : Banks to buy and sell on domestic commodity exchanges, where mobilized gold can be delivered.

- Lending to jewellers : For lending to jewellers

Lending the Gold to the Jewellers

- Gold Loan Account: The jewellers, on the basis of the terms and conditions of the banks, will get a Gold Loan Account opened at the bank.

- Delivery of gold to jewellers: When a gold loan is sanctioned, the jewellers will receive physical delivery of gold from the refiners. The banks will in turn make the requisite entry in the jewellers’ Gold Loan Account.

- Interest received by banks: The interest rate charged by the banks will have to cover the following: (1) Interest rate paid to the depositors of gold (2) Fee paid to the refiners and Purity Verification Centres. (3) Profit margin of the banks

The banks can directly get gold from the international market on a consignment basis and lend it to the jewellers. If this route is more lucrative, then the entire purpose will get defeated. Thus, this aspect will also have to be kept in mind, while deciding the interest rate.